There was a time when Shop.org was the premier conference and expo for e-commerce.

But today, there are precious few distinctions being made between different forms of commerce. There may well come a day — and soon — when solutions are universal and housed under one big event umbrella.

Still, Shop.org managed to give attendees in Los Angeles a peek into the digital future, one in which virtual reality looms large, augmented reality is upon us and…

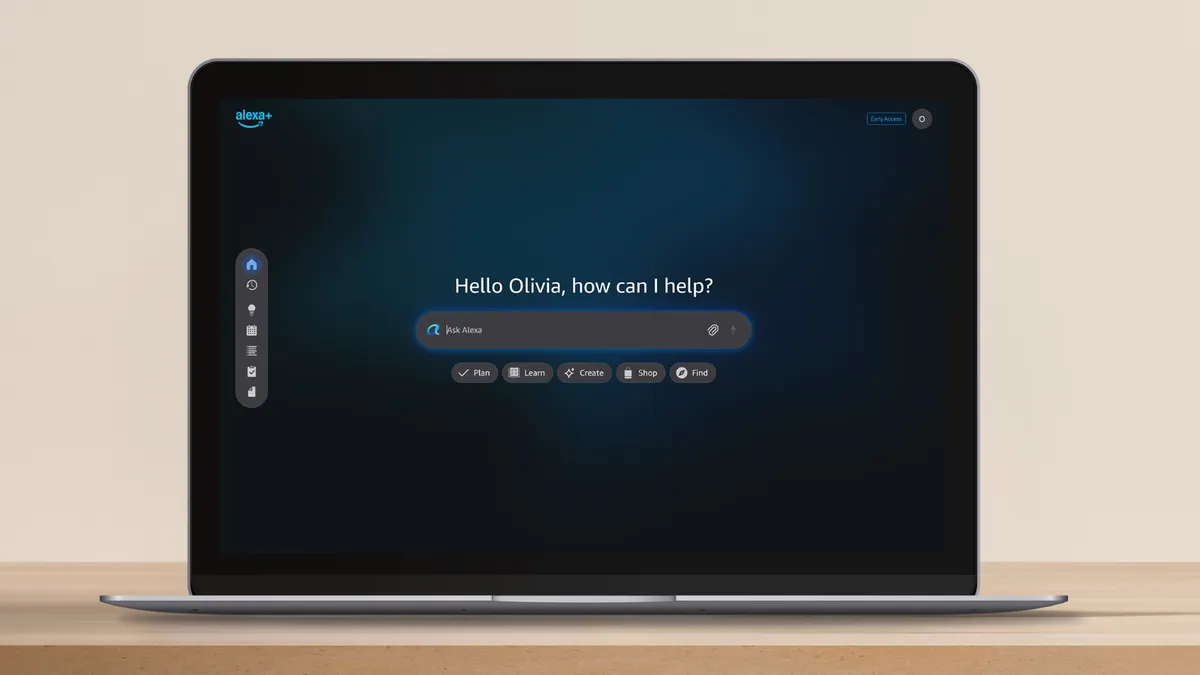

1. Voice is everywhere

Voice is the technology of the day.

Artificial intelligence and its companion, voice, are the most talked about innovations in retail and the ones most likely to make the biggest and most immediate impact.

"There are quite a few vendors here touting AI for lots of different use cases," Michelle Grant, head of retailing at Euromonitor International, told Retail Dive. "This will inform competitive intelligence, personalization and recommendations, natural language processing — it is enabling new things to happen at scale that haven't been seen before."

At the show, there were AI messaging platforms — many with a focus on Facebook Messenger — and even an early stage interactive hologram from Vntana that responds to questions like, "where's the food court?"

2. VR is coming

Augmented reality is already here — it's being added to multiple shopping platforms across channels — but virtual reality shouldn't be ignored.

Walmart's U.S. e-commerce President Marc Lore is a big believer in VR and so are plenty of technology companies working to make it a reality. "It's still early days for [VR], but once we get comfortable shopping via voice, imagine getting immersed into an environment where the products you're looking to buy can be experienced in their native environment," Lore said during a keynote Tuesday. "That's pretty exciting."

There are still plenty of barriers, not the least of which is the high price point, Grant said. But she added: "I'm more bullish than I had been before."

3. Data mining has moved beyond marketing

Retailers' collection and use of data is far more sophisticated today, and being used for a lot more than marketing.

Kohl's, for example, is using search data to inform merchandising and product decisions, Sarah Rasmusen, vice president of digital merchandising and analytics for the retailer, told attendees at a Wednesday morning session.

Some 400,000 searches for Under Armour products that came up empty — the brand simply wasn't carried at Kohl's — helped bring the brand to the retailer. When searches for off-the-shoulder women's tops spiked and also came up empty, Rasmusen's team identified the demand and partnered with product development to speed the style into production and stores.

Another retailer, Fabletics, has been using data from physical stores to not only inform online inventory but to improve product design. According to TechStyle Fashion Group co-founder and co-CEO Adam Goldenberg, the data from the dressing room is among the most important being gathered across all the company's channels.

"The highest dressing room conversation rate is what matters," Goldenberg said during a Tuesday keynote. "Online returns aren't as important as dressing room conversion."

Shoppers may not return an online purchase due to a manufacturing flaw, but they won't buy an item after it's been tried on and found to be faulty. Identifying a problem — as Fabletics did with a single size of a specific apparel item — increased conversion rates and sales in stores and improved customer satisfaction online.

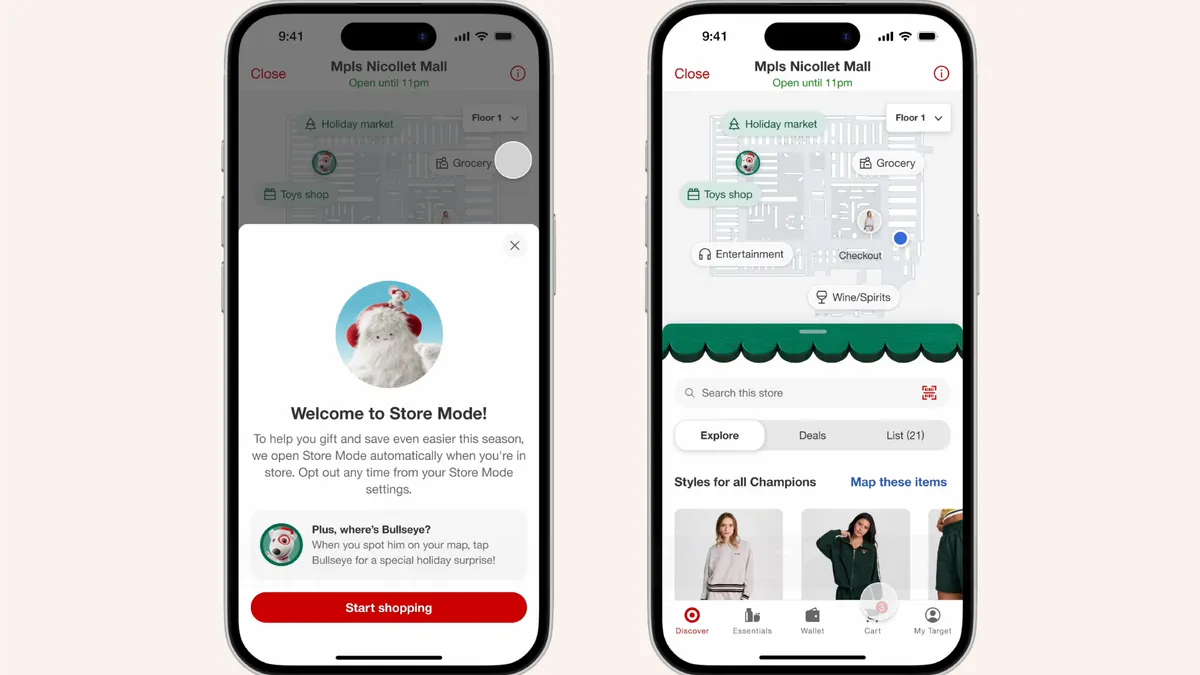

4. Mobile is everything

Retail has moved past using mobile as a browsing device for e-commerce. Smartphones — not tablets, which are having very little impact as a standalone access point, Kohl's Rasmusen said — are the best point of contact between merchant and shopper.

But getting shoppers to the store and providing context along the way is just as critical, according to panelists who spoke during a session called "The Mobile Shopper Mapped," moderated by Retail Dive in Shop.org's Retail Innovation Lounge. Searches for items or locations "near me" have increased by 146% in the past year, according to location marketing platform Uberall — and 88% of those are coming from a mobile device.

This provides brands with an opportunity to influence shopping behavior in several key ways, said Paul Berman, director of enterprise partnerships at Uberall.

Kohl's is using mobile search data to help inform merchandising and product decisions. "Find the product, find the store, find it inside the store. For the customer, 'searchability' and 'findability' means the same thing for online and in the store," said Kohl's Rasmusen.

5. The battle for the last mile

"The battle is the last mile," Jon Reily, vice president of business and customer strategy at SapientRazorfish, told Retail Dive. This is a big part of why Amazon bought Whole Foods and why it has partnered with Kohl's to create drop-off points for shoppers and handle returns.

The last mile is fueling not just new technology, but acquisition strategies throughout retail — and it will likely look a lot different in the future than it does today, mused Steve White, vice president of commerce strategy at SapientRazorfish.

The cost of sending product to populated areas is lower due to economies of scale as opposed to sending a single shipment to outlying areas. In other words, it costs less to send an aggregated number of items to customers in Chicago than a single shopper in North Dakota. Today, one region is subsidizing another, but it's not hard to imagine a future where that can no longer be supported and pricing will vary by region.

"I don’t think we can continue to treat the entire U.S. the same," said White. He expects delivery prices to be more reflective of costs to retailers, who can't keep carrying fulfillment as a loss.

We'll see retailers continue to experiment across channels with programs to solve the last mile problem. One example is Walmart's test of having store associates deliver packages on their way home. This is a test that Lore told attendees at the show was going well and showing high demand.

6. Commerce is unified

Perhaps there was a time when retail could be divided up into channels and solutions could be targeted accordingly. But that time may be over if Shop.org and other recent trade shows are any indication.

There is precious little variety in vendor representation and conference programming speaks to a new universal truth of retail: Omnichannel really means all. Mobile, desktop, digital, physical — it's all one experience in the eyes of the shopper. Retailers can't differentiate and succeed.

7. Amazon is the elephant in the room

While there were few mentions of Amazon at Shop.org — and certainly no representatives from the retailer could be found on panels or wandering the show floor — Amazon was top of mind for many.

It's fitting that Amazon held a press conference during Shop.org to announce new Echo devices, stealing attention away from the industry event.

Everyone in retail wants to be better equipped to compete with Amazon. Or they want to know how to partner with the retail and technology giant. And they want to learn from Amazon to improve their own business. Walmart may still be the world's largest retailer, but Amazon is the most watched.