It was a year of advancement and anxiety. More than 9,000 stores closed in 2019, according to Coresight Research. America's shaky trade relationships with other countries created anxiety among retailers and consumers. Additionally, brands and retailers continued to shift their omnichannel strategies to bridge the online and offline shopping experiences — specifically when it came to mobile strategies, which shone in the fourth quarter. According to one study, smartphones accounted for 84% of the holiday season's e-commerce growth.

And there are no signs of a slowdown. As 2020 goes into full swing, experts weigh in on what mobile trends could lie ahead.

1. Curtailed data collection

In 2018, the European Union implemented its General Data Protection Regulations, restricting how much data companies could collect from individuals. California also passed the California Consumer Privacy Act of 2018, which went into effect Jan. 1 of this year and also provides data privacy protections.

Both Jaclyn Osterloh, account director at Sparkloft Media, and Adam Pressman, managing director at AlixPartners, suspect restrictions to consumer data collection may be on the horizon. Whether doing so is sparked by a policy change or not, retailers will need to communicate with consumers via their mobile app or site about how they use the information they collect, Pressman said.

"Because of certain policy changes that are being enacted or just overall customer trust, retailers need to be really clear as to the request for information, whether it's while someone is signing up for an account or signing up for an app," Pressman said.

2. Harvesting behavioral data

In 2020, collecting consumer data will enable retailers to understand their customers better, such as providing more relevant results and recommendations, Pressman said.

For retailers with a mobile app, harnessing data from mobile devices will allow retailers to build thorough consumer profiles and thus provide shoppers with automated, personalized service, said Andy Halliwell, head of UK retail for Publicis Sapient. With a mobile app, retailers can examine consumers' behavioral data such as their search history, product comparison history and what items they've viewed, which will let retailers offer customized campaigns and tailor their merchandising to each individual, he said.

"What [Netflix] will do is customize the icons for each of the films or each of the TV shows based on what they believe you'll be most interested in from that show," Halliwell said. "I think we're going to start seeing that kind of technology applied much, much more to retail experiences in the future."

3. Reaching Gen Z through TikTok

By now, most marketers understand veteran social media platforms popular with millennials, but soon Gen Z will become more of a target audience for brands, Osterloh said. She said she's looking to see which retailers begin marketing to Gen Z consumers via platforms like TikTok, which have gained popularity with the young demographic.

Retailers like Hollister, Macy's and Guess have begun experimenting with campaigns on TikTok, but many brands haven't made an attempt yet.

"To do it right, you have to let go of this polished idea of your brand and try to be more human and relatable," Osterloh said.

4. Improving in-store experiences with staffer tech

Retailers will continue to experiment with using mobile devices to provide store associates with the information they need to assist customers and streamline the checkout process, Pressman said. He added that retailers will refine their metrics of success and clarify how these tools will help shoppers. Stein Mart and Decathlon have recently introduced mobile devices to modernize the checkout experience, among many others, like Walmart, which have been working with the tech longer.

By giving mobile devices to employees to complete in-store transactions, retailers can use the technology to create an "endless aisle experience." That means employees can locate goods available at various locations and help customers buy and ship items to their homes, Halliwell said. Retailers have already been providing floor associates with iPads, Microsoft Surface tablets and other devices to offer shoppers more options without a sizeable physical store footprint, he added.

5. Testing trends on social media

Though Instagram, Pinterest and Facebook allow users other ways to shop online, the technology facilitating those social network purchases still needs work and people aren't totally comfortable buying through those platforms yet. But they will become powerful tools in the near future, Halliwell said.

Halliwell pointed to the cosmetics company Glossier as an example of a brand that captivates consumers through its social content and uses social media feedback to understand what trends are among its audience, thus influencing what the company should create next. Other brands, such as Nike, Apple, Levi's and Adidas have been looking to social media communities to understand what's leading customers to buy merchandise and build loyalty, he added.

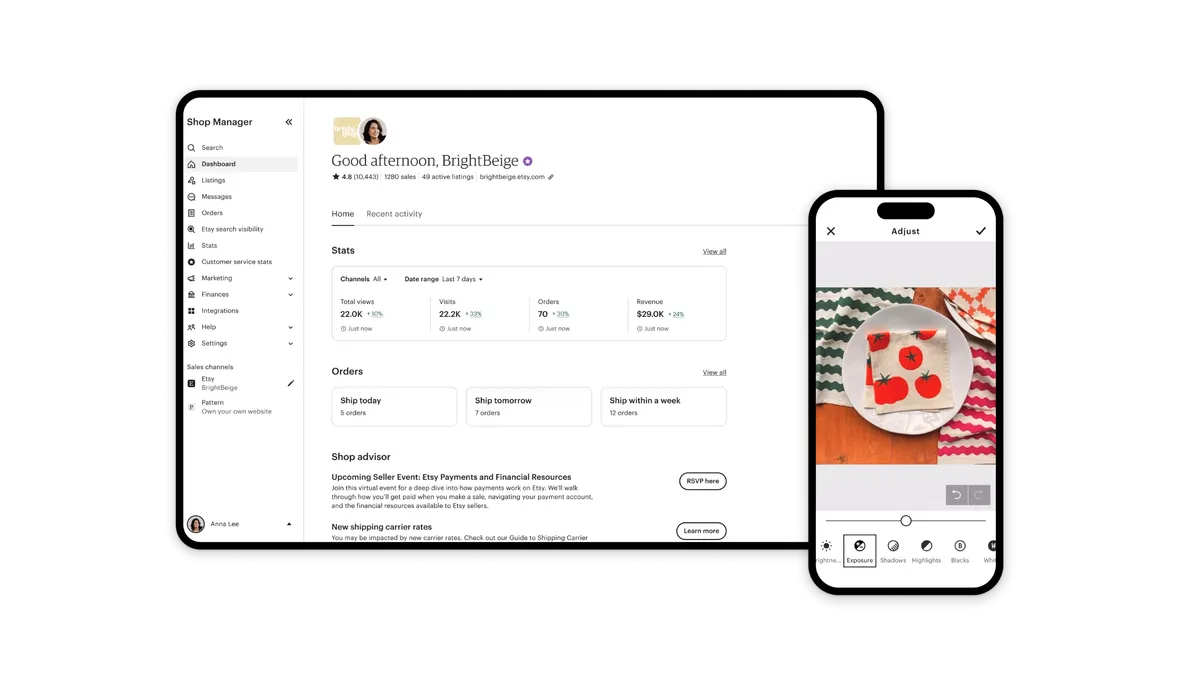

6. Improving app features

It's not clear if all businesses, especially small retailers, need a mobile app. However, a 2019 Shopgate report found that half of retailers are prioritizing a mobile shopping app as part of their omnichannel strategy. Brands and retailers such as Asos and Amazon will continue to experiment with visual search on their apps, Halliwell said. Mobile apps will be increasingly critical for prominent brands that want to deliver app capabilities that mobile sites cannot.

This year and going forward, retailers will need to understand how to engage their consumers via mobile through, for example, introducing new features after they download the app or understanding when to alert users with various mobile notifications, Pressman said.

"There are different movements afoot, whether it's turning off notifications or trying to create more downtime for us as individuals," Pressman said. "Those retailers that are really able to be relevant and helpful are going to be the ones that customers permit and allow to communicate with them."

Halliwell also noted that most consumers don't want a bunch of apps with differing shopping experiences on their phone, which creates visual clutter, unless they are a loyal customer. Tools like Google's Progressive Web Apps feature some mobile app capabilities useful to retailers such as location tracking, product catalog integration and offline mode, he said, adding that the tool has become more popular recently.

7. Streamlining mobile purchases

As some retailers continue to close stores, retailers' brick-and-mortar locations will function more as flagship locations where consumers can test products before ordering them online, Osterloh said. Macy's, for example, is moving toward a flagship model and updating its app to improve consumers' mobile shopping experience, she said.

"I think we'll evolve to see retailers hold less and less on the floor and have more available through your device and go to a location and pick it up, or have it show up directly at your house," Osterloh said.

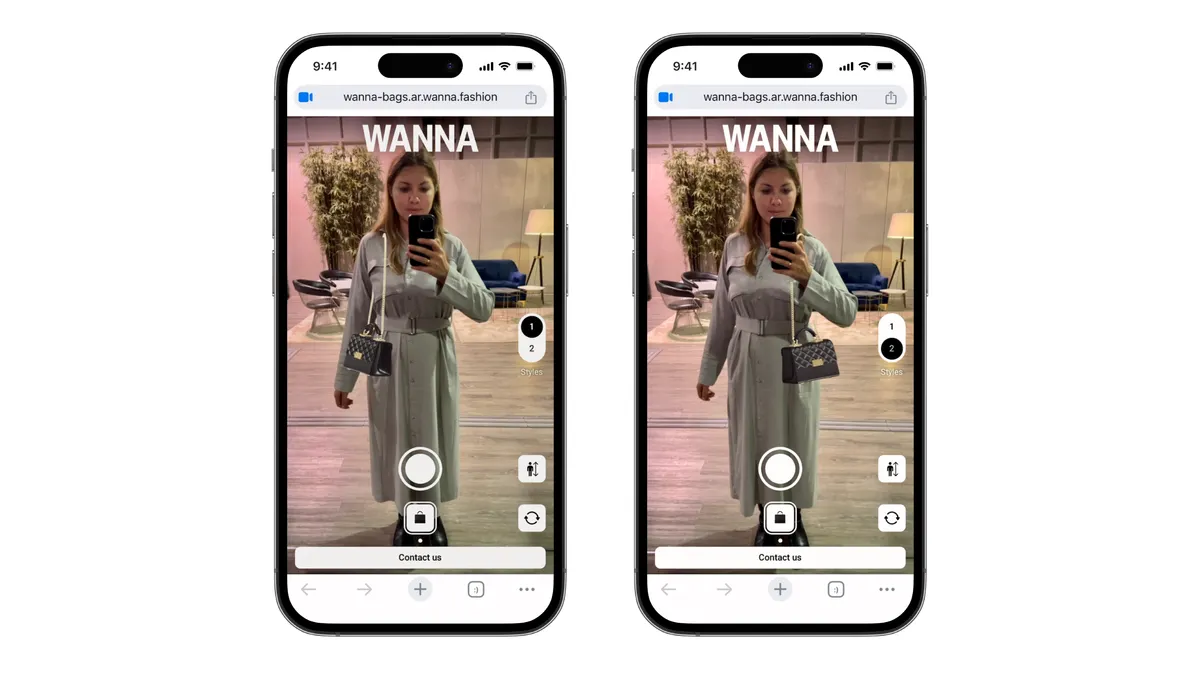

This year and in the future, retailers' mobile sites or apps will need to be responsive and able to facilitate purchases quickly, Pressman said, adding that introducing AR and VR features won't make up for an overall poor mobile experience.

"With having so many different choices out in the marketplace ... that ability to really execute is going to be critical, as it always has been," Pressman said.