No one was more pigheaded than Thomas Edison.

The Wizard of Menlo Park didn’t nail the light bulb on the first try. Or the second. Or the third.

According to legend, Edison cycled through ten-freaking-thousand light bulb prototypes before finally hitting on the magic formula. History does not record how much smack talk Edison endured for his missteps, but no matter: “I have not failed 10,000 times. I have not failed once. I have succeeded in proving that those 10,000 ways will not work,” he maintained. “When I have eliminated the ways that will not work, I will find the way that will work.”

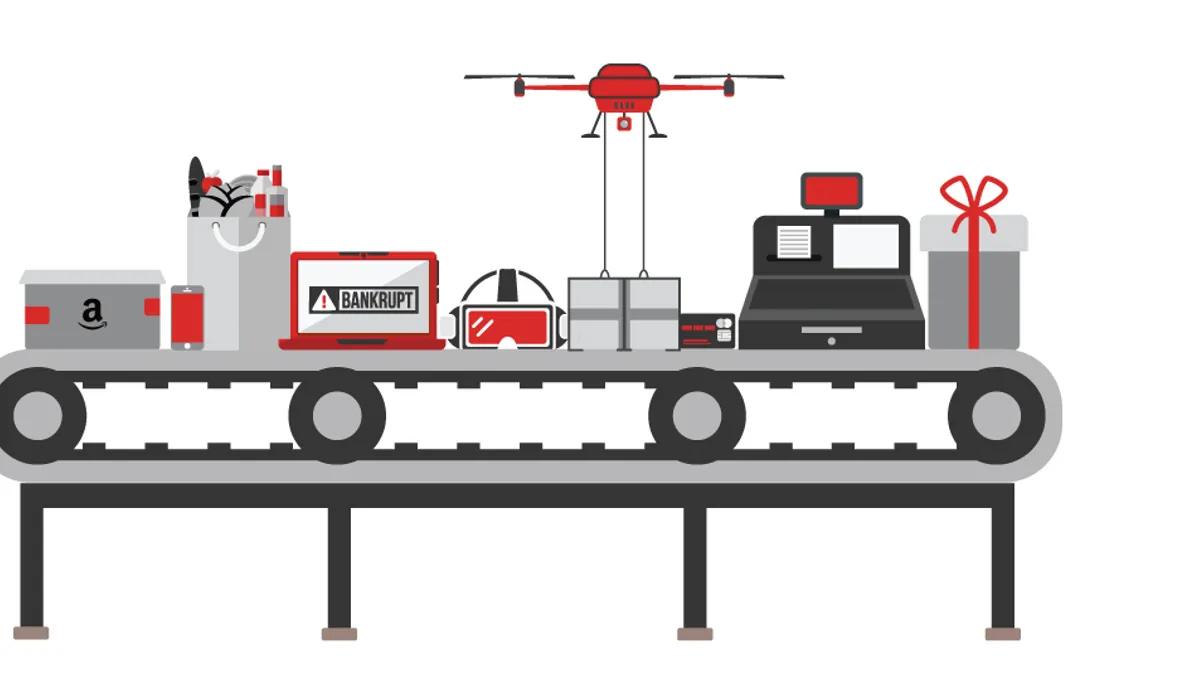

Retailers have not yet eliminated the ways that will not work. Outdoor retailer Gander Mountain is the latest chain on the brink of Chapter 11 bankruptcy. J. Crew is mired in debt and legal problems. Electronics retailer HHGregg is weighing its options to restructure its own debt. The problem isn’t just that these retailers are failing; it’s how they’re failing — i.e., remaining entrenched in the same old ways of doing business, and falling prey to the same competitive pressures that have already spelled doom for dozens of other brick-and-mortar merchants.

Retailers must find new ways to fail in order to survive, according to consulting firm Deloitte’s just-released 2017 Retail and Distribution Outlook.

“Agility and flexibility are apt to be required for retailers to thrive in 2017 and beyond,” writes Deloitte Vice Chairman Rod Sides, who leads the company’s U.S. Retail & Distribution practice. “In the race to deliver customer value, 90-day assessment programs have given way to an accelerated pace of ‘fail fast, learn quickly, move forward’ and succeed early by delivering minimum viable products. Established players may be at greater risk of losing market share to retail disruptors who are held to different standards and better able to exploit organizational and operational agility.”

It’s an entrepreneurial model that’s benefited innovators in Menlo Park, Silicon Valley and startup hotbeds across the globe — and it can work for lumbering legacy retailers too, Sides contends.

“A lot of the venture funds today will fund 30, 40 or 50 startups a quarter, and they’ll see if they can get to a minimum viable model and what kind of acceptance they get in the marketplace. If they don’t find the traction they’re looking for, they’ll shut it down immediately and move on to the next thing,” Sides told me via phone. “Retailers have to do the exact same thing. When you find something that works, rather than testing through three cycles, you’re going to have to make decisions and go, and figure out a way to get out ahead of the competition. The pace of change will only accelerate.”

True, agility and flexibility are not exactly retailer strong suits. If they were, brands like The Limited, Wet Seal and Sports Authority might still be around. But Sides says that agile development philosophies are slowly but surely seeping into the retail ranks.

“We’re seeing it behind the scenes with a lot of our clients. For their development activities — new offerings, new technologies, etc. — they’re adopting an agile type of approach,” he said. “It may not be evident to those outside, but they’re starting to take a lot of those tenets of moving quickly and embedding them in the organization. Do they get it right most of the time? No. But they understand they have to go after it.”

Look for survival-minded retailers to apply their newfound nimbleness to explore a range of opportunities (and neutralize a wave of threats) in the months ahead, Sides said, forecasting that new third-party vendor and partner relationships, the Internet of Things and robotics (in stores, in warehouses and even in the cloud) all will disrupt the status quo moving forward. Actually, scratch that: Disruption is the new status quo, according to Deloitte — and not everyone will survive the shakeout. The question is which retailers will fail once and for all, and which will keep failing but learning from their mistakes... until the proverbial light bulb finally goes on above their heads.

Here’s what else is worth your time and attention this week…

TRENDING UP

- Off-price plus-size: Based on demand for higher quality apparel in larger sizes, Neiman Marcus is introducing plus-size apparel departments in five of its off-price Last Call stores.

- Little drummer boys: In its latest release of contemporary characters, American Girl has included a boy doll for the first time — “Logan,” the drummer friend of new character “Tenney Grant,” who bears a striking resemblance to country-pop star Taylor Swift in her younger years.

- Equality champions: Timed with February's Black History Month, Nike has launched a new equality-themed advertising and social awareness campaign, including a film featuring sports celebrities like LeBron James and Serena Williams.

TRENDING DOWN

- Tarnished Armour: In an open letter, Under Armour CEO Kevin Plank sought to walk back his earlier contention that President Donald Trump would be an “asset” to the country after an analyst said Plank's comments undermined the brand’s efforts to “build a cool urban lifestyle brand in the foreseeable future.”

- Trouble brewing: Wal-Mart is the target of a lawsuit that alleges its private-label craft beer — which it claims to produce in collaboration with a Rochester, NY brewery — is a “wholesale fiction.”

- Mall drats: “Reciprocal easement agreements” are hamstringing mall landlords, preventing them from making strategic modifications to make their shopping centers more attractive to consumers.

STAT OF THE WEEK

8 million: The number of products artisan platform Etsy’s new craft supplies marketplace will offer at launch. The typical big-box craft supply store offers about 33,000.

PARTING SHOT

“We should go back to the drawing board, roll up our sleeves and find another way that doesn’t propose a new law that’s going to pick winners and losers among industries.” — National Retail Federation President and CEO Matthew Shay on the so-called “border adjustment tax” proposed on goods imported to the U.S.