Walmart detailed plans to acquire virtual fitting room startup Zeekit last month in an attempt to solve some of consumers' most prevalent issues when shopping for clothes online: fit and unmet expectations.

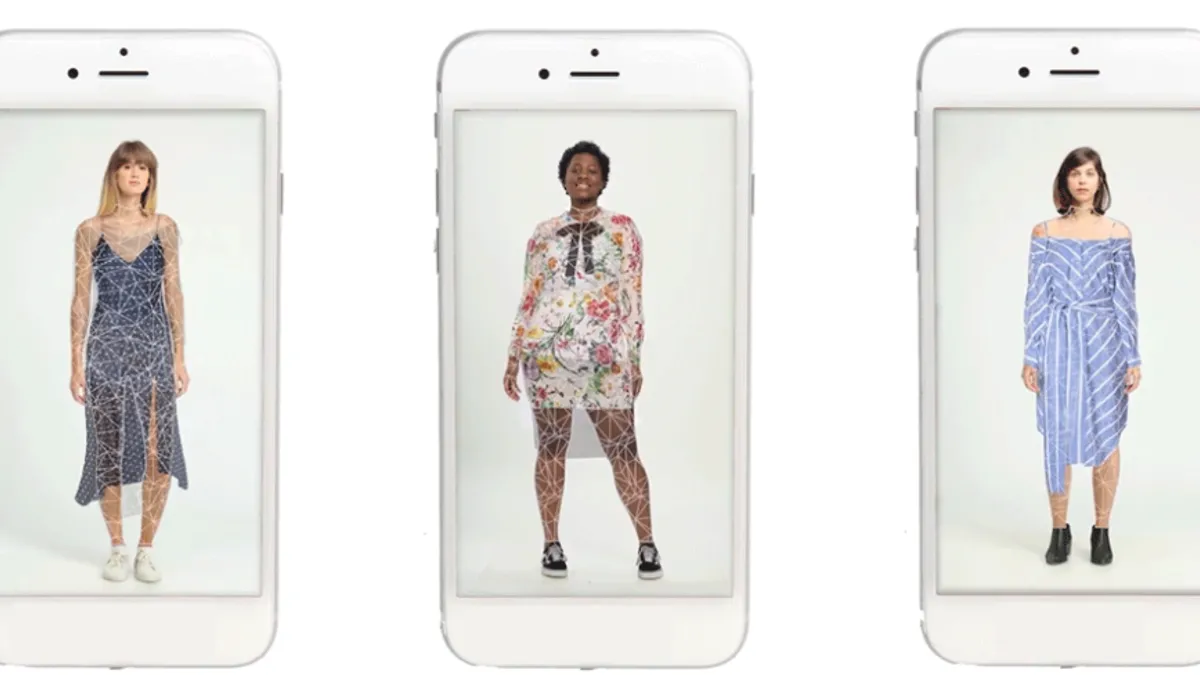

The Bentonville, Arkansas, retailer acquired Zeekit — a female-founded startup based in Israel — for an undisclosed amount. Zeekit's technology allows consumers to virtually try on clothing before purchase by uploading pictures of themselves or choosing from a selection of models that best represent their body characteristics.

Acquiring Zeekit is Walmart's latest bid to expand its focus on fashion. Walmart has been attempting to reinvent its fashion reputation in recent years, expanding its apparel offering through acquisitions, launching private labels and hiring award-winning designer Brandon Maxwell as creative director for two of its exclusive brands.

"This startup combines fashion and technology through a dynamic virtual fitting room and underscores the desire to grow our apparel business aggressively," Walmart President and CEO Doug McMillon said on a recent call with investors and analysts.

Throughout the pandemic, several companies have invested in try-on technology of some sort as physical fitting rooms closed, and concerns about the virus potentially spreading on surfaces pushed retailers to remove product testers off the shelves.

"Walmart is the largest store-based retailer in the U.S., but like all other brands and retailers, they're increasingly looking toward e-commerce for growth now."

Benjamin Schneider

Research Analyst for Fashion and Luxury at Euromonitor International

Snapchat acquired Fit Analytics in March as part of its long-term goal to blend augmented reality and e-commerce. Google also launched its own AR try-on tool for beauty back in December. With cleanliness and safety in mind earlier in the pandemic, apparel rental company Armoire released a digital dressing room for members, dubbed "Looks."

It was a prime time for many retailers and brands to participate in innovative ways to market their merchandise, said Benjamin Schneider, research analyst for fashion and luxury at Euromonitor International. Virtual try-on especially taps into some of the aspects of shopping that consumers missed during the pandemic, he said. It also solves inconsistencies in sizing based on brand and where the clothing is from (Asian sizes, for instance, typically run smaller than U.S. sizes).

"Walmart is the largest store-based retailer in the U.S., but like all other brands and retailers, they're increasingly looking toward e-commerce for growth now," he said. Not only will virtual fitting rooms help customers feel more confident about their purchases, but "customers are going to be far less likely to return the items since they've already been able to try it on virtually, which is a win-win for both Walmart customers and also for Walmart."

A tool fit for the long haul

Virtual try-on technology not only alleviates some of the pain points of online shopping, but it also gives Walmart access to valuable data that could potentially identify consumers' clothing preferences or which demographic gravitates toward certain designs, said Schneider.

"Walmart can use [this data] to inform future product and brand decisions and really have the tool pay off, not only in the short term, driving sales, but also in the long term," said Schneider. "The effective use of this data would really help to promote loyal, repeat customers for the retailer."

This technology was well on its way to the mainstream market, said Ronald Goodstein, associate professor of marketing at Georgetown's McDonough School of Business. The pandemic merely exacerbated the speed at which the retail industry began to adopt it, he added.

Zeekit has attempted to make virtual fitting rooms more mainstream before being acquired by Walmart through past partnerships with Adidas, Macy's and Asos. "They're basically taking [Zeekit] out of the market from everybody else," Goodstein said.

The global virtual fitting room market is estimated to reach about $15.4 billion by 2028 according to a recent report from Grand View Research. The market is expected to increase from 2021 to 2028 at a compound annual growth rate of 25.2%, the report said.

"Here's the disconnect: this technology, if you look at how well it fits with the brand that purchased it... is pretty high-end and great for consumers, but I would think that technology would be used for upper-tier brands," Goodstein said, suggesting that Walmart may be trying to "move a little more upstream."

The retailer, known for its affordable prices and not exactly for high-street products, has indeed been busy making a push in the fashion segment.

Walmart launched private label Free Assembly in September and revived fashion brand Scoop in 2019. In recent years, it expanded its apparel offerings by acquiring Bonobos, Moosejaw and DTC plus-sized brand Eloquii.

"A couple of years ago they put out a posting saying that they're trying to acquire some killer brands to augment their e-commerce effort," said John Harmon, senior analyst at Coresight Research. The Zeekit acquisition was a change of direction for Walmart, he added. "They bought Jet.com four or five years ago for their e-commerce technology, but Walmart's other acquisitions have been brands, but now they're branching out and looking at technologies."

The fitting solution to returns

Fit and unmet expectations, two issues that Walmart said Zeekit may solve, sit on the top half of the list of reasons shoppers return items, according to Incisiv and Newmine's recent report on retail returns. Shoppers typically don't purchase products with the intention of returning them, but when they do, 73% of the time the retailer could have controlled it, the report said.

With Walmart's e-commerce sales continuing to grow even post 2020, the financial problems associated with disappointed online shoppers and returns are becoming harder to ignore.

"In a simple way of saying it, if you make it easy for people to shop online, they will, and they'll [make a] return at three to four times the rate of brick-and-mortar stores," said Tony Sciarrotta, executive director of the Reverse Logistics Association. The rise in returns directly relates to unmet expectations, and if retailers "figure out a way to make sure that you meet or exceed your customer's expectations when that package arrives on their front porch, then you've found the Holy Grail."

When the pandemic drove e-commerce spending to record levels last year, so did the amount of items returned.

The rate of online returns in 2020 more than doubled from 2019, the National Retail Federation estimates. Shoppers returned $428 billion in merchandise across all retail categories last year, with apparel being the second most returned product category, the January report indicates.

An internal case study from 3DLook said its technology could reduce returns by 30%. Zeekit itself told Insider pre-acquisition that it decreases returns by 36% and states on its website that it has a conversion rate of 20%.

Still, there are some aspects of returns that virtual fitting room technology won't solve, said Sciarrotta. For instance, the color or material of the product may appear different on the computer screen than it does in real life. And then there are some consumers who deliberately buy different sizes of the same clothing with the intention of keeping one that fits them best and returning the rest.

"Most of the world, they're a little more careful about buying, and the culture differences are they don't tend to return things, they live with it. We tend to return things because it's easy," said Sciarrotta. "Walmart's trying to figure out how to reduce the impact because they can't stop [returns]."

The mainstream adoption of virtual fitting rooms

Some of the biggest players in retail have yet to adopt this relatively new fitting room technology into their operations. Sciarrotta said it requires more commonplace use for this technology to have a significant impact on returns.

"Not only do you need adoption widespread, but you need accuracy," he said. "If we discount those other return reasons and you make this program widespread, I'd say you could impact maybe 20% to 25% of the returns — not that you could reduce it from 40% to 20%, but you could reduce the overall volume."

Then there's the question of whether consumers would actually use the fitting room tool as a shopping tool rather than for entertainment purposes, like how consumers have used some of Snapchat's AR filters throughout the years. Gucci partnered with Snapchat last year for an AR filter that lets users try on shoes and buy them, for example.

"It's definitely helped to develop brand awareness," said Euromonitor's Schneider. While Snapchat's dominant user demographic, Gen Z, may not be able to afford Gucci products at the moment, he said the luxury brand has at least improved its presence on the platform. "Maybe as soon as they do have the purchasing power to buy something like that, they're gonna go with a brand that they've already connected with at an earlier stage."

Though some consumers may not be technologically savvy enough to think about using virtual fitting rooms at the moment, Schneider said consumers would naturally adapt to tools that facilitate their shopping experience.

"I think it really speaks to consumers' familiarity with using all of these tools. I don't know how long ago that would have been now, but people used to say, 'I would never buy clothes online because how are you going to know if it's going to fit me,'" he said. "Sooner or later, consumers got over the fact that it's not too difficult to try."