Dive Brief:

- New research from L2 reports that 62% of retail brands now offer in-store inventory on product detail pages. The study, "Omnichannel: Pathways to Success" said the year-over-year number was up dramatically from 35% in 2016.

- Of the sectors studied by L2, specialty retail brands made the most improvements in omnichannel competency, seeing a 75% increase in adoption of the analyzed site features.

- While 71% of retail brands use geolocation within their store locators, only 60% of those brands close the commerce loop by supporting the infrastructure for in-store pickup.

Dive Insight:

For the report, L2 analyzed 85 brands in 2016 and 2017 across the activewear, beauty, big box, department store, fashion, grocery, specialty retail and watches and jewelry sectors. L2 evaluated 28 site features and capabilities, including presence of store locators, integrated store inventory, and e-commerce and fulfillment. Overall, adoption across three-quarters of these features has risen year over year for retailers, L2 reported.

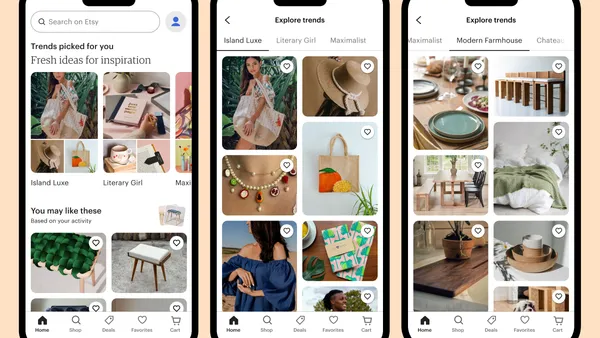

Among the retail sectors examined, home brands – such as Williams-Sonoma, Ethan Allen and Pier 1 Imports – have quickly made improvements to their omnichannel features. These home brands reported increased adoption in 16 out of the total 28 omnichannel features analyzed year over year.

Luxury retailers, like fashion brand Salvatore Ferragamo, depend on store visits to sell high-touch products and seek up sell opportunities. The company was noted in a previous L2 report for its cumbersome store locator pages. But Ferragamo overhauled its site and now has effective omnichannel capabilities throughout its purchase funnel. It is one of the most improved brands in the report.

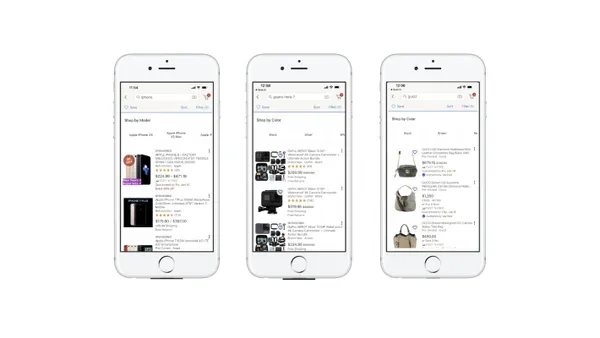

In other reports, BJ’s has unveiled a new mobile app with an Add-to-Cart feature that allows customers to save coupons directly to their club membership cards. Kohl’s believes that customers want to shop both digitally and in brick-and-mortar stores, and has made driving traffic and operation excellence priorities.

Omnichannel is an ongoing challenge to retailers, but one they know they must meet and overcome. A report from Brightpearl has shown that only 8% of retailers have mastered omnichannel, although 90% have an omnichannel strategy or plan to invest in it soon. Boston Retail Partners said 81% of retailers will deploy unified commerce platforms by 2020.

Retail brands that are now just catching up with the fast growing e-commerce world need to build an implementation roadmap so as to drive e-commerce and in-store benefits while also taking into account the complexity of implementation, L2 said.