Dive Brief:

- Poshmark has agreed to be acquired by South Korean internet giant Naver in a deal that gives Poshmark an enterprise value of $1.2 billion.

- Under the deal, Poshmark would sell all of its outstanding shares to Naver for $17.90 a share, which is a premium to its recent trading price but less than half the price that the resale marketplace’s shares sold at in its initial public offering less than two years ago.

- The companies expect the deal to close in the first quarter of 2023. The acquisition is subject to shareholder approval, though Naver said it has secured voting and support agreements from stockholders representing 77% of Poshmark’s outstanding shares.

Dive Insight:

In the announcement of Poshmark’s acquisition, the companies said the merger aims to combine “Poshmark’s unique discovery-based social shopping platform and deeply engaged community with Naver’s technological prowess in upleveling the e-commerce experience.”

Naver claims to operate South Korea’s top search engine and the country’s largest e-commerce platform, as well as a host of other digital businesses, including fintech and cloud services.

Naver CEO Choi Soo-Yeon said in the deal announcement that the company’s “technology in search, AI recommendation and e-commerce tools will help power the next phase of Poshmark’s global growth.”

Poshmark’s founder and CEO, Manish Chandra, echoed this, saying that Naver’s “financial resources, significant technology capabilities, and leading presence across Asia to expand our platform, elevate our product and user experiences, and enter new and large markets.”

Along with its technology, Naver touted the community of bloggers and monthly users that use its online platforms, as well as its Shopping Live livestream shopping market, which Naver said did $25 billion in gross merchandise value last year.

“Naver expects that the enablement and enhancement of live streaming capabilities within the Poshmark platform will transform the shopping and selling experience and strengthen Poshmark’s community by allowing for greater social networking and engagement,” the companies said in the release.

The deal took at least some observers by surprise. David Bellinger and Michael Lesser, executive directors with MKM Partners, said in a research note that they were “a bit perplexed” by Poshmark’s deal to sell itself.

“In our view, the [Poshmark] model has had its shortcomings recently and found difficulties in driving sustained top-line growth and adjusted EBITDA profitability,” the analysts said, noting also that changes to Apple’s privacy policies hurt Poshmark’s ability to target marketing. “That said, we see this deal as potentially picking off a promising consumer concept still in the early stages of growth and operating well below its full potential.”

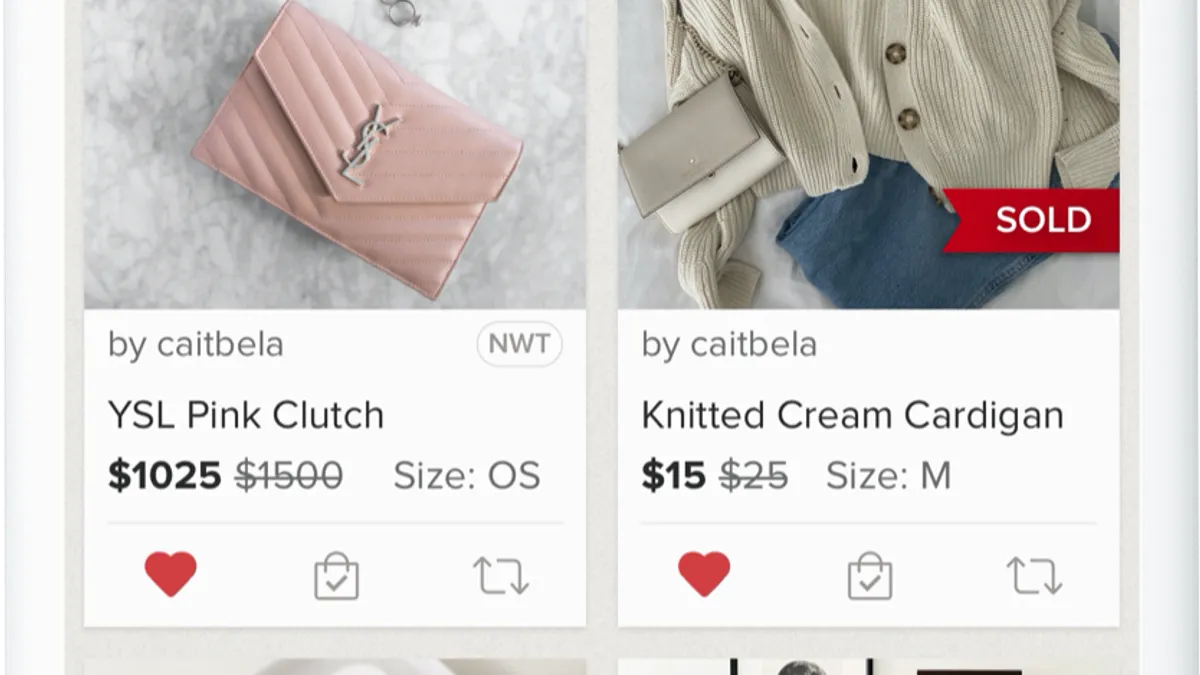

That potential rests in the growth possibilities in online apparel resale, where Poshmark has staked out its relevance. Consumers have increasingly embraced resale both as a way to save money on top brands and as a way to shop more sustainably.

At the time Poshmark filed for an IPO, MKM Partners wrote that the marketplace’s growth, along with other players including ThredUp, also “underscores the demand to participate in resale as a seller, which we believe has likely been super-charged by the pandemic.”

As resale has become more mainstream, Poshmark has opened up its platform to brands to sell directly on its website along with individual sellers.