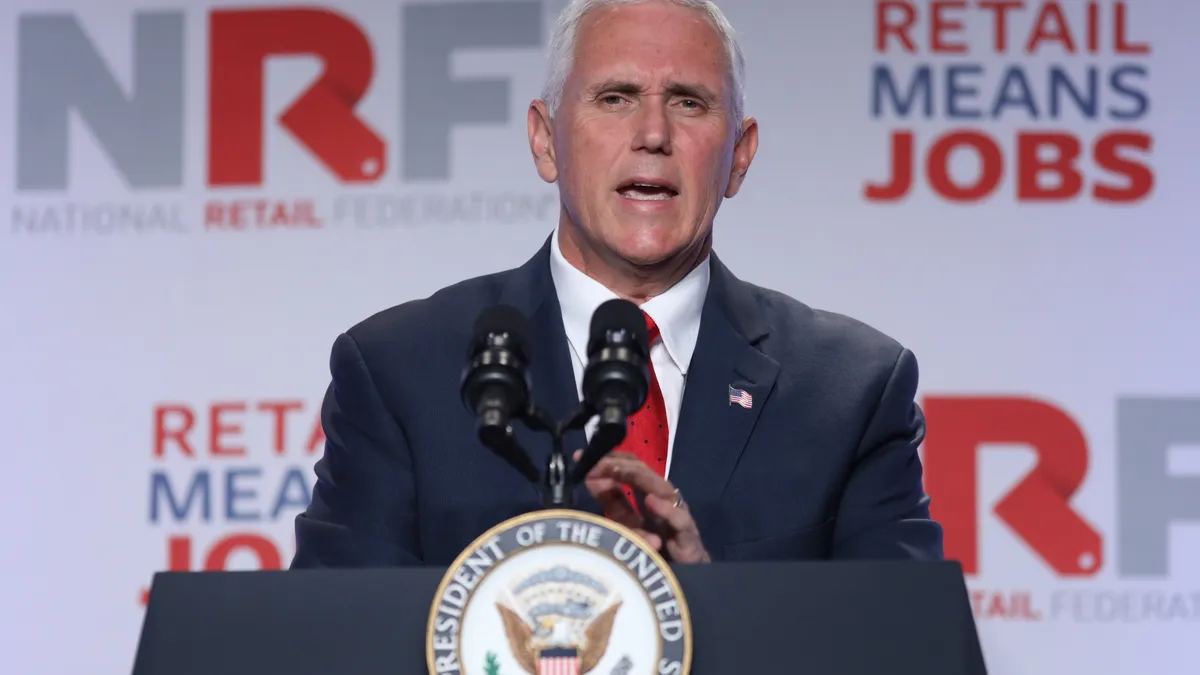

WASHINGTON — Vice President Mike Pence took the stage at the National Retail Federation’s Retail Advocacy Summit in Washington D.C. Tuesday to address some of the biggest public policy issues facing the industry. Key on the agenda — tax reform.

“I want to assure you that our president knows as retail goes, so goes America,” Pence told a group of roughly 200 mostly small business retailers. “Our administration is very focused on the issues that will encourage economic growth, growth you will need to grow and succeed.”

Namely, Pence conveyed President Donald Trump’s support for a plan that cuts the corporate tax rate to 15%, implements a territorial tax and brings money back into the United States to grow the economy. “This president is going to work with this Congress this year, and we are going to pass the largest tax cut since the days of Ronald Reagan,” he said to a cheering audience of retailers eager to get down to work on the advocacy front.

A focus on the BAT

Over the next few days, executives attending the summit will move from the Hyatt Regency, where they will discuss positions on tax reform, healthcare and the regulatory environment, to the Hill to meet with dozens of legislators to convey their message. Their biggest lobby effort is against the border adjustment tax, which has been hotly debated in the House of Representatives Ways and Means committee for months.

"By being here this week, and by adding your voices to this debate, you’re making a huge contribution to our interests to ensure BAT remains off the table once and for all," David French, senior vice president of government relations at the NRF, told executives on Tuesday.

The GOP proposed 20% tax on imports has quickly become the most controversial public policy measure to face the industry in years, and trade associations like the NRF have played a major role in rallying members against the measure. In fact, retailer lobbying spend rose 31% in the first quarter of 2017 compared to the year-ago period, hitting $16.4 million, according to data collected by Open Secrets. The total spend last year was $45.8 million.

The proposed tax stands to swallow $13 billion from six major U.S. retailers' annual earnings alone. In February, more than 120 retailers and trade organizations launched a national coalition, dubbed “Americans for Affordable Products,” to argue that the tax would unfairly hit on consumers by raising the costs of clothing, food, medicine, gas and other household items.

The issue has come into the spotlight in recent months as high-profile retail chiefs like Target CEO Brian Cornell have gotten involved in the matter. For Target, the proposal would cause the big-box retailer's tax rate to more than double from 35% to 75%, Cornell testified to members of the House of Representatives’ Ways and Means committee in May. “It’s pretty simple math,” he said. “If the government takes four out of every five dollars we make, there’s no capital to invest and no prospects for growth — and that matters a lot both to us and the U.S. economy. Instead of investing and creating jobs we would be pushed in another direction.”

While Congressman Lloyd Doggett (D-TX) characterized the proposal as being “on life support” in May, retail trade organizations and executives know the war hasn't been won quite yet. “We’ll come back again and again and beat it,” French said Tuesday. “The effectiveness of the retail message this year is an indication of how dead [the BAT] should be.”

Notably missing from Pence’s speech to retailers was any mention of support or disdain for the BAT, instead he expressed favor of a territorial tax, a measure French told Retail Dive would put the U.S. in line with the rest of the world by not taxing income earned outside of the country. A territorial taxation system and the border adjustment tax are like "apples and kumquats," H. David Rosenbloom, director of the International Tax Program at New York University and attorney at law firm Caplin & Drysdale, told Retail Dive.

"The border adjustable tax had both an inbound and an outbound component, a denial of deductions for imports and an exception on exports had to do with goods or services crossing the border," he said. "The territorial tax idea had to do with how the U.S. taxes foreign sourced income. [A territorial taxation system is] not so much the movement of goods as the taxation of income earned abroad, investments abroad."

The absence of support for BAT in Pence's speech is "a clear sign that the administration is moving on,” French told Retail Dive.

To be clear, the BAT isn’t quite dead yet, but it may be soon. Freedom Caucus conservative Mark Sanford (R-SC) told Politico on Tuesday evening he is considering an amendment to the fiscal 2018 budget that aims to kill off the BAT. “Everybody says border adjustment tax is dead. I think it is, and it seems to be the prevailing viewpoint,” Sanford told Politico. “But you still have the speaker of the House and the head of the committee of jurisdiction behind this. So, it’s never over until it’s over.”

Chairman of the Ways and Means committee Kevin Brady as recently as June said he favors a five-year phase in of the BAT. But most onlookers, including Rosenbloom, consider BAT on its way out the door.

“I think it’s dead. I don't think that’s coming back,” Rosenbloom said. “The problem [Congress has] got, a big one — it’s easy to lower taxes, but raising money to offset the lowering isn’t. The people who get hurt scream louder than the people getting helped.”

Pushing back on the retail apocalypse narrative

Matthew Shay, NRF president, also used the summit kick off to push back on an "apocalyptic narrative" conveyed by the media, which has consistently reported on the record number of store closures and bankruptcies announced so far this year.

“The story being told about the retail industry right now is clearly not an accurate story. We need to push back on that narrative,” Shay said. “We need to tell the story of an industry that’s in transformation for sure, but industry that is not going anywhere anytime soon.”

Pence also voiced his optimism for the industry. "The NRF slogan sums it up best. Retail means jobs, and the best days for American retailers are up ahead, I promise you."

Shay acknowledged that some segments of the industry and some brands are in “challenging times,” but urged retailers to tell Congress and others the broader story. “If you do one thing this week in addition to having all of those conversations about policy, I think you need to push back and push back hard on this narrative,” he said. “For this generation of retailers, this is the opportunity for us at this moment.