Chief executive officers in retail occupy a challenging position.

They’re ultimately responsible for the company’s financial and operational performance and brand equity. Many major retailers also have thousands or even tens of thousands of employees along with huge real estate footprints.

Corporate boards, shareholders and other members of the executive team also look to CEOs to cast a vision and put plans into action to respond to business trends and issues that are outside anyone’s control, like the economy, inflation, the weather, changing consumer tastes or decisions made by vendors or competing companies.

At times, CEO transitions can seem like a game of musical chairs as leaders move between rival companies into similar roles. One example of this is to follow the journey of Brad Weston, who took over as CEO of At Home in June. Weston replaced former CEO Lee Bird, who retired at the end of last year. Before that, Weston was CEO of Party City until the company successfully exited Chapter 11 bankruptcy.

Party City itself then had multiple CEOs shortly after Weston’s tenure, with Chief Commercial Officer Sean Thompson serving as interim CEO following Weston’s departure. Then, in August, the retailer chose Barry Litwin, a turnaround specialist, as its next president and chief executive officer, replacing Thompson.

Some executives step down for personal reasons, while others agree to leave — or are forced out — ahead of major changes, like entering or leaving bankruptcy. Here are five major CEO changes so far this year at U.S. retailers:

Tony Spring, Macy’s

When Spring took over as CEO of Macy’s Inc. in February, the move officially completed a planned leadership transition that was announced in March 2023, nearly a year earlier. Spring succeeded Jeff Gennette, who had held the role since 2017 and retired after 40 years with the company.

Before his ascension to CEO, Spring held various roles within the company’s Bloomingdale’s segment for about 36 years. As CEO, he now leads a company with about 720 stores under three main banners as of August. They are Macy’s, Bloomingdales and beauty brand Bluemercury, which is marking its 25th anniversary this year.

Right from the start, Spring has confronted some big business challenges. First, about a month after becoming CEO, Spring said closing 150 stores was essential to the company’s survival. The banner’s footprint, he said, was too big and built for a different era. He said the company plans to push forward with closing the stores over the next three years.

Spring has also battled with activist investors since taking over. Late last year, Arkhouse Management and Brigade Capital Management put a $5.8 billion offer on the table to take the department store company private. Macy’s rejected it. Arkhouse and Brigade came back with a nearly $7 billion offer. Macy’s ended the takeover talks in July, citing insufficient information on how the deal would be financed and the fact that some of the financing terms would have been tied to the company’s real estate.

Despite those challenges, Spring expressed confidence in Macy’s place in the retail world during a recent Goldman Sachs global retailing conference.

“There are fewer players in our space,” Spring said, according to a transcript. “We're going to have a healthier business. It's going to be an assisted-selling business at Macy's. It's going to be a full selling experience at Bloomingdale's and Bluemercury. And there are plenty of customers who don't want to buy all of their products in off-price and mass.”

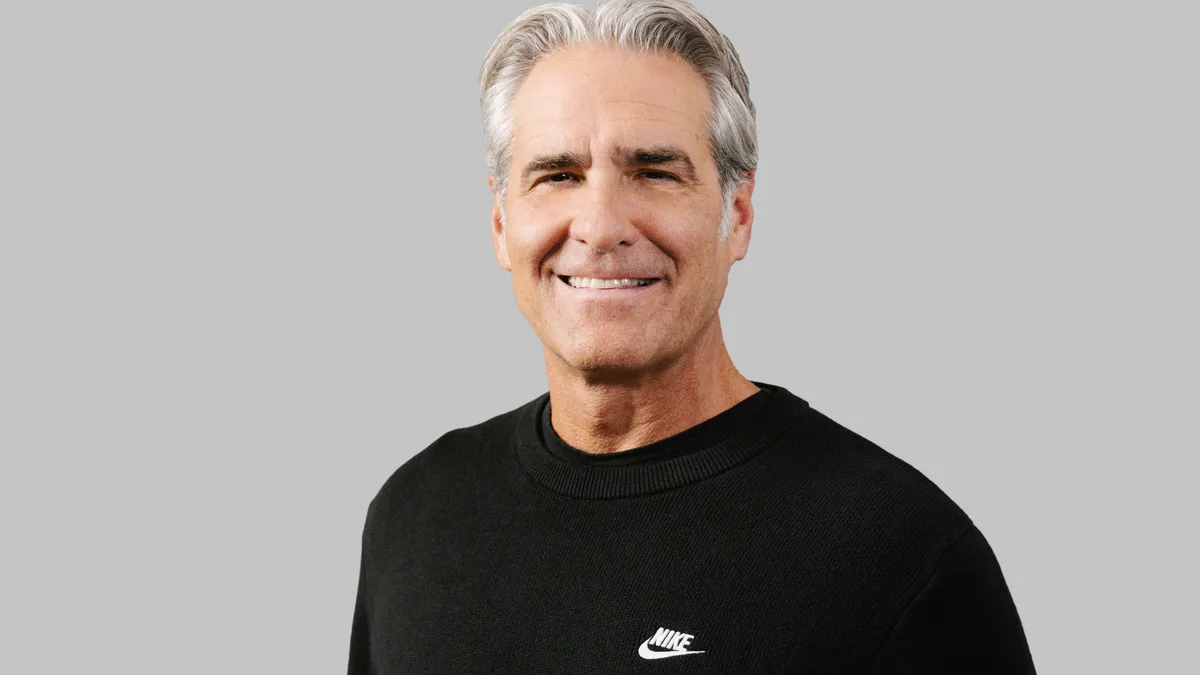

Elliott Hill, Nike

Nike announced Sept. 19 that Elliott Hill would replace John Donahoe as CEO on Oct. 14.

Hill was Nike’s president of consumer and marketplace when he retired in 2020 after 32 years with the company. In that role, he led all commercial and marketing operations for Nike and the Jordan brand. During his first run with Nike, Hill also held various senior leadership positions across Europe and North America.

In a statement, Hill said Nike has “always been a core part” of his identity and that he looked forward to reconnecting with the company’s employees and trusted partners while also building new relationships.

The CEO change came as performance at the global footwear and sportswear brand has been soft and uneven. Revenue was up just 0.3% for the most recent fiscal year at $51.4 billion, while Q4 revenue fell 2% to $12.6 billion.

Donahoe acknowledged the issues and pledged to get back on track by focusing less on direct-to-consumer sales and more on wholesale and product innovation. Donahoe will stay with the company in an advisory role through early next year.

During an earnings call in June, Donahoe described fiscal year 2025 as a transition year for the business, adding that Nike was “making a series of adjustments to position us to compete and win.” Those changes included sharpening its focus on sports, accelerating the pace of newness and innovation, and bolder storytelling, according to a call transcript. Donahoe also said Nike was working to fuel its brand distinction to better place itself in the path of consumers.

Joel Anderson, Petco

After nearly 10 years of leading tween and teen-focused discount retailer Five Below, CEO Joel Anderson unexpectedly resigned from Five Below on July 16 “to pursue other interests,” according to a company press release.

His exit followed a time of soft earnings. Just ahead of Anderson’s departure, Five Below reported a Q1 year-over-year net sales rise of nearly 12% to $812 million. But comparable sales for the quarter fell 2.3% versus the prior year.

Two days after Anderson’s departure from Five Below became public, Petco announced that he would join that company as its CEO, effective July 29. Anderson replaced Mike Mohan, who had been serving as Petco’s interim CEO since March after former head Ron Coughlin left his position after six years.

During his final earnings call at Five Below, Anderson said the retailer’s core customer was prioritizing needs over wants, which had a major impact on performance in the first quarter, leading the company to adopt an offensive position. Still, Anderson added, Five Below planned to continue its store growth plans.

In contrast, for the quarter ended Aug. 3, Petco reported net revenue of $1.52 billion, which was nearly flat year over year and a comp sales rise of 0.3% from the prior year. During his first earnings call as head of that retailer, Anderson shared why he joined the company.

He described Petco as “an incredible brand which sits at a critical juncture,” according to a call transcript. “While we maintain a differentiated proposition within the resilient pet category, a category which is expected to reach $200 billion in sales within five years, there are clear opportunities to significantly improve our operating and financial performance.”

Hillary Super, Victoria’s Secret

After just over a year as head of intimates and accessories brand Savage x Fenty, Hillary Super left that company on Sept. 9 to become CEO of Victoria’s Secret & Co. Super replaced Martin Waters, who was terminated after about three years in the position. His departure was “not the result of any dispute or disagreement with the company,” according to a regulatory filing with the U.S. Securities and Exchange Commission.

In addition to its namesake brand, the company’s portfolio includes lifestyle loungewear brand Pink and Adore Me.

“The strength of these iconic brands, supplemented by an incredible beauty business, provides numerous opportunities for future growth,” Super said in a statement.

Super said her vision for Victoria’s Secret & Co. includes making the company the world’s leading fashion retailer of intimate apparel, expanding its cultural influence and creating a dominant global market position to grow shareholder value.

In the same statement, Waters said he was proud of the company’s accomplishments during his tenure. They included international expansion, enhanced operational efficiency and improvements to the company culture.

Victoria’s Secret swung to a profit in Q2 from a year-over-year net loss of $872,000. The company also reported net sales of about $1.4 billion, a decline of 1% from the prior year. Total comps also fell 3% during the quarter. The company raised its guidance during its Q2 earnings report. It expects fiscal year 2024 net sales to be down about 1%, versus earlier guidance of a low-single-digit decline.

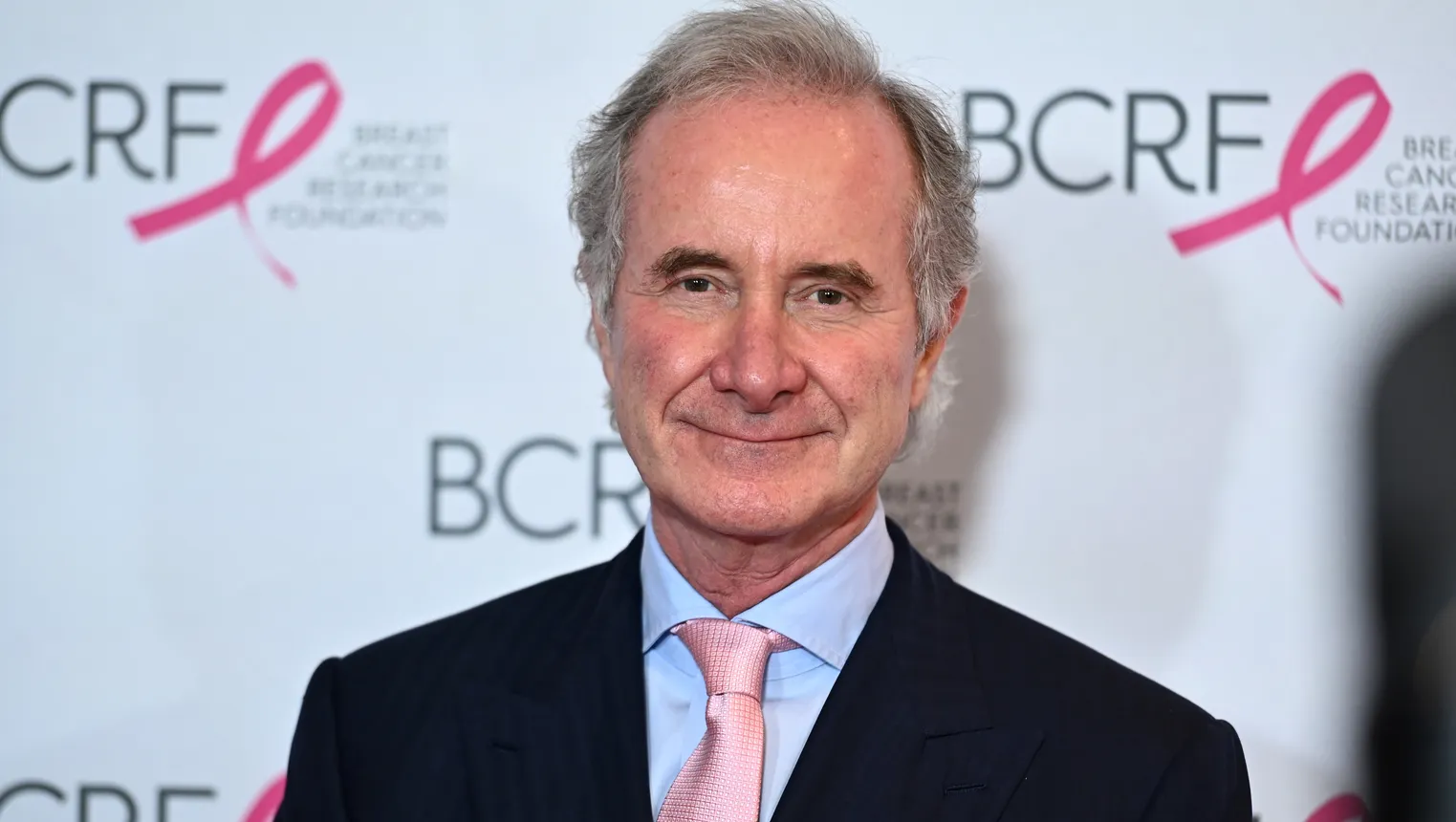

Fabrizio Freda, Estée Lauder Companies

Estée Lauder Companies CEO Fabrizio Freda said in August that he plans to exit at the end of the fiscal year, after 16 years leading the business. Freda is leaving as the beauty company is in the midst of implementing a turnaround. The board has already considered candidates to replace him, according to a press release.

Freda will stay on after the appointment of his successor and remain with the company in fiscal year 2026 as an adviser. In addition to Estée Lauder, the company’s brand portfolio includes Aramis, Clinique, The Ordinary, Smashbox and Aerin Beauty, among others.

At the same time, Estée Lauder reported net sales dropped nearly 2% to $15.6 billion for the fiscal year ended June 30, and net earnings fell to $409 million from nearly $1 billion the year prior. Earlier this year, the company said it would lay off up to 5% of its workforce as part of a restructuring plan that was set to start during the third quarter.

“While our sales and profit outlook for fiscal year 2025 is disappointing, this year we will make important strides as we implement our strategy reset to continue rebalancing regional growth, deliver improved annual profitability, strengthen go-to-market and innovation capabilities to elevate our execution in response to a more competitive market,” Freda said according to an earnings call transcript.