Dive Brief:

-

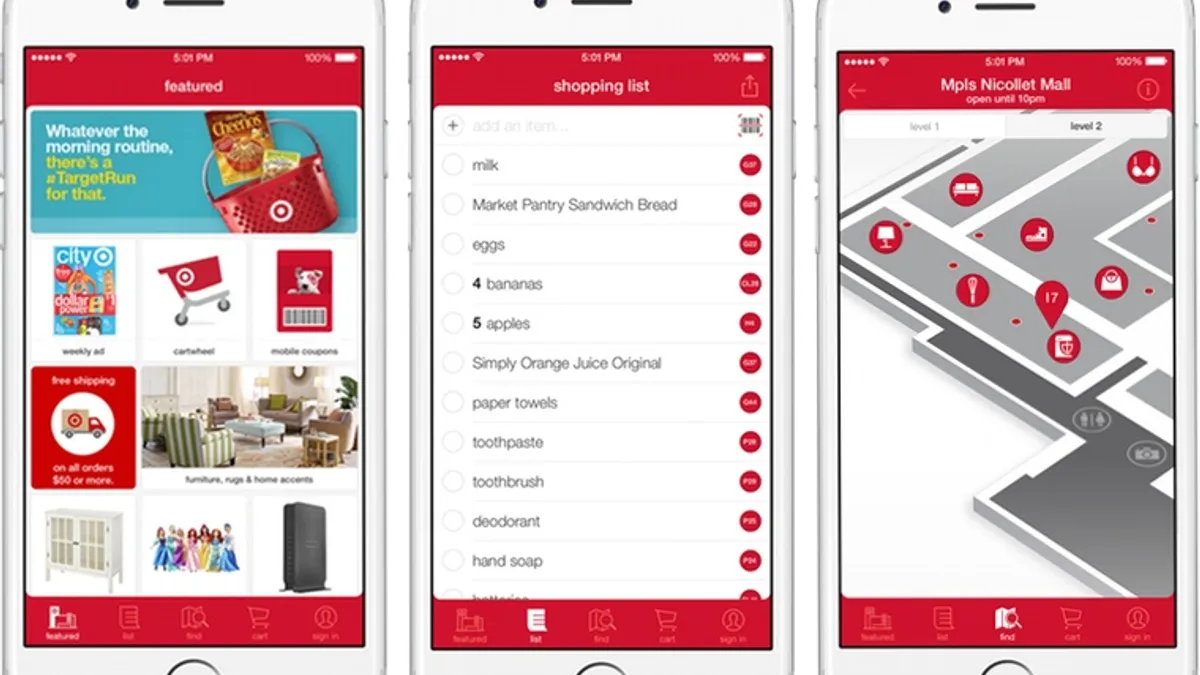

Target Corp. is working on its own mobile wallet, sources have told Reuters.

-

The Target wallet is far enough along to have partnerships with credit card issuers and advanced technology, possibly using QR codes and eschewing near-field communications, but hasn’t been tested in stores, according to Reuters.

-

Wal-Mart earlier this month also rolled out its own mobile payment app, called Walmart Pay.

Dive Insight:

The wallet wars have heated up considerably since the advent of Apple Pay a little over a year ago. Android Pay and Samsung Pay have entered the field, and now Wal-Mart, and, apparently, Target.

Noticeably absent, though, is CurrentC, the mobile app that was spearheaded by Wal-Mart and embraced at one point by a group of retailers that also included Target.

That doesn’t mean that CurrentC is doomed. But the app faces a series of challenges of its own making, including multiple delays to its launch. In the meantime, look for more MCX retailers to announce that they’ll be accepting Apple Pay, Google Wallet, and now Samsung Pay after all—or, possibly, developing their own wallets altogether.

Mobile shopping has been on the increase and this holiday season saw a surge in search and other mobile shopping activity. But mobile payments is not so much part of that story, though many experts have told Retail Dive that it’s just a matter of time before mobile payments become normal for the average consumer. An “open loop” wallet like Android, Apple, or Samsung is more likely to catch on, many say, than a retailer-specific app.

“We believe in these ‘super wallets’ or non-closed wallets like Apple, Samsung, Visa, MasterCard, that you can use across all your apps,” says payments company BlueSnap CEO Ralph Dangelmaier. “Plus PayPal and the international guys. That’s not to say that people won’t use others.”