They say keep your friends close, but enemies closer.

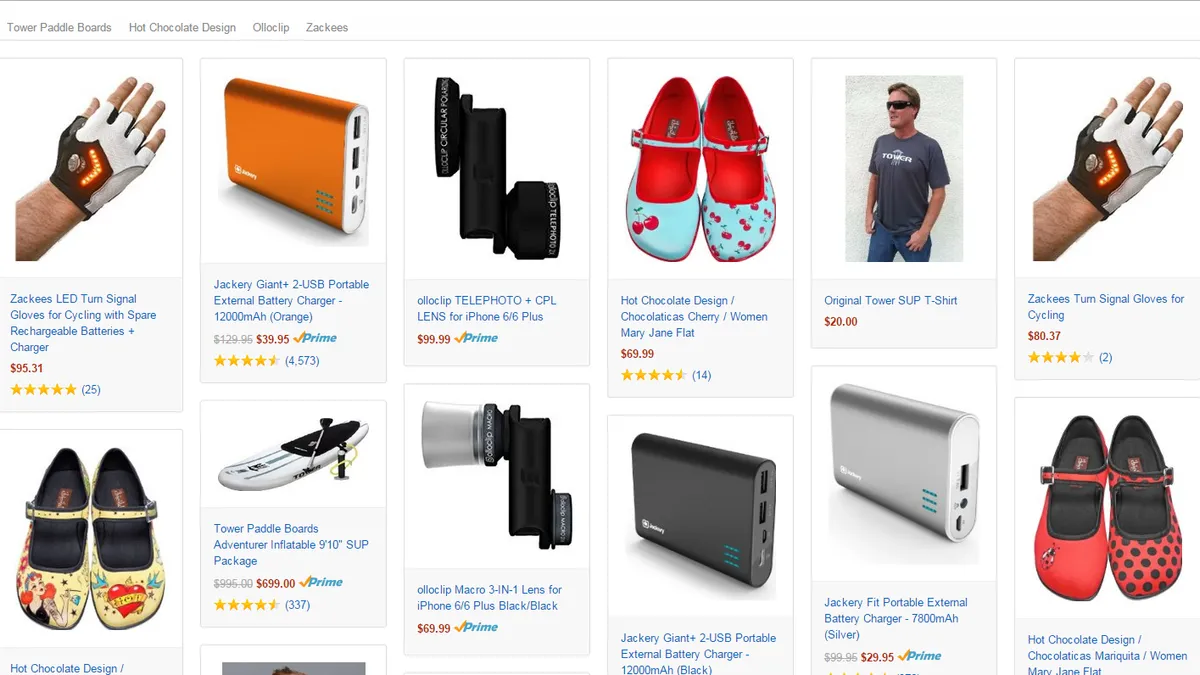

Retailers seem to be taking this adage to heart, with 32% planning on spending more to sell their wares in online marketplaces this year compared to last, according to the NRF’s “State of Retailing Online 2015” report.

One of the primary drivers of this spending? Amazon, seemingly the driver of all things e-commerce. According to Forrester, 39% of U.S. shoppers started their purchase journey by researching on Amazon in the third quarter of 2014, compared to just 11% who started on search engines.

While Amazon is one of the major pacesetters in the growth of online marketplaces, Wal-Mart and Alibaba, both behemoths in their own right, also offer this service to other retailers.

With this in mind, RetailWire, an online retail discussion forum, asked its BrainTrust panel of retail experts these two questions:

- What are the pros and cons for retailers around selling on Amazon.com and other online marketplaces?

- How should retailers react to search engines such as Google losing their influence as the first place to start online product searches?

Here are some of the best answers from that discussion. Comments have been edited by Retail Dive for content and length.

1. Beware of the “great white shark”

Chris Petersen, PhD, President, Integrated Marketing Solutions: If a retailer can open marketplaces on Amazon that are good for Amazon it can benefit both. But Amazon benefits most by getting another player to help fund distribution infrastructure and costs.

But history shows that if a category takes off and becomes significant, Amazon can quickly find suppliers to compete in that category directly.

Amazon is still the great white shark of e-commerce. But there is another whale called Alibaba. And Walmart is becoming credible and expanding third-party sellers. The key is being able to use different marketplaces to reach your target consumers where they shop.

2. For larger retailers, the brand might be at risk

Mark Heckman, Principal, Mark Heckman Consulting: The obvious first reaction to this question is the potential loss of the retailer's own brand identity if they choose to sell through another online retailer. That said, if you are a smaller retailer with more sales to gain than brand equity to lose, selling on Amazon is likely a good decision.

For larger retailers, whose brand equity and product integrity are vital components of their go-to-market strategy, there are risks aplenty with subordinating your online strategy to a company that will become the customer-facing retail brand to the consumer, leaving the individual retailer as a mere commodity brand.

3. It’s all about location

Gene Detroyer, Professor, Independent: Remember, "location, location, location." It is as important in the online world as the real estate world. Amazon, et. al., have the locations. That is where the shoppers are. Why would you build your "store" someplace else?

4. Double-edge sword

Steve Montgomery, President, b2b Solutions, LLC: Yes, you get exposure you might not have been able to achieve on your own, but if you become really successful you also get something else. A large, well-funded competitor.

5. Physical partnerships go online

Carol Spieckerman, President, newmarketbuilders: Marketplaces are really just a digital version of retailer-to-retailer partnerships (much like shop-in-shops in physical retail). Marketplaces are a potential life-saver for category killers like Staples that must expand into non-core categories or play race-to-the-bottom with Amazon.

6. A global advantage

Dan Frechtling, SVP Product and Marketing, CMO, G2 Web Services: The best value marketplaces offer is access to a new customer base. In other words, marketplaces bring customers you would not have a realistic shot of acquiring if you tried to sell directly to them.

Alibaba, and to a lesser extent JD.com, bring the Chinese middle class to global retailers. This amounts to 557 million internet users. Amazon uses Alibaba's Tmall platform to sell to Chinese shoppers, as does Costco and Macy's.

Marketplaces that tap global markets, especially those lacking Western goods, provide an upside to retailers large and small.

7. Online marketplaces—a ‘virtual mall’

Shep Hyken, Chief Amazement Officer, Shepard Presentations, LLC: I look at online marketplaces as a virtual mall. Retailers pay rent to the mall management or ownership. If it is the Amazon.com marketplace, the "sliver to deliver" is the rent. So does the retailer want to expand to other (online) "malls?" Even if Amazon has more SEO than the retailer, once the customer buys through that channel, the retailer now has a direct connection. I'm a fan of this concept.

8. ‘Proceed with caution’

Brian Numainville, Principal, The Retail Feedback Group: While the concept itself may be sound, the idea of helping to fund what could be your competition is a concern, as is giving up your brand identity. If you are small and need to ramp up your brand, this might be a good approach. But otherwise, proceed with caution.