Dive Brief:

-

Amazon is planning to expand its Prime Now delivery service to two cities in Canada as early as this year, people familiar with the matter told The Wall Street Journal.

-

A pilot of the one- and two-hour delivery service in Vancouver and Toronto — the same areas with Whole Foods locations, which are now owned by the e-commerce giant — could begin as early as November, according to the report.

-

"Amazon has a longstanding practice of not commenting on our future roadmap," a spokesperson told Retail Dive in an email in response to a request for more information.

Dive Insight:

In addition to serving as an expansion of its brick-and-mortar footprint and of its grocery operations, Amazon’s takeover of Whole Foods is an expansion of the e-commerce giant’s logistics, point-of-sale and merchandising systems.

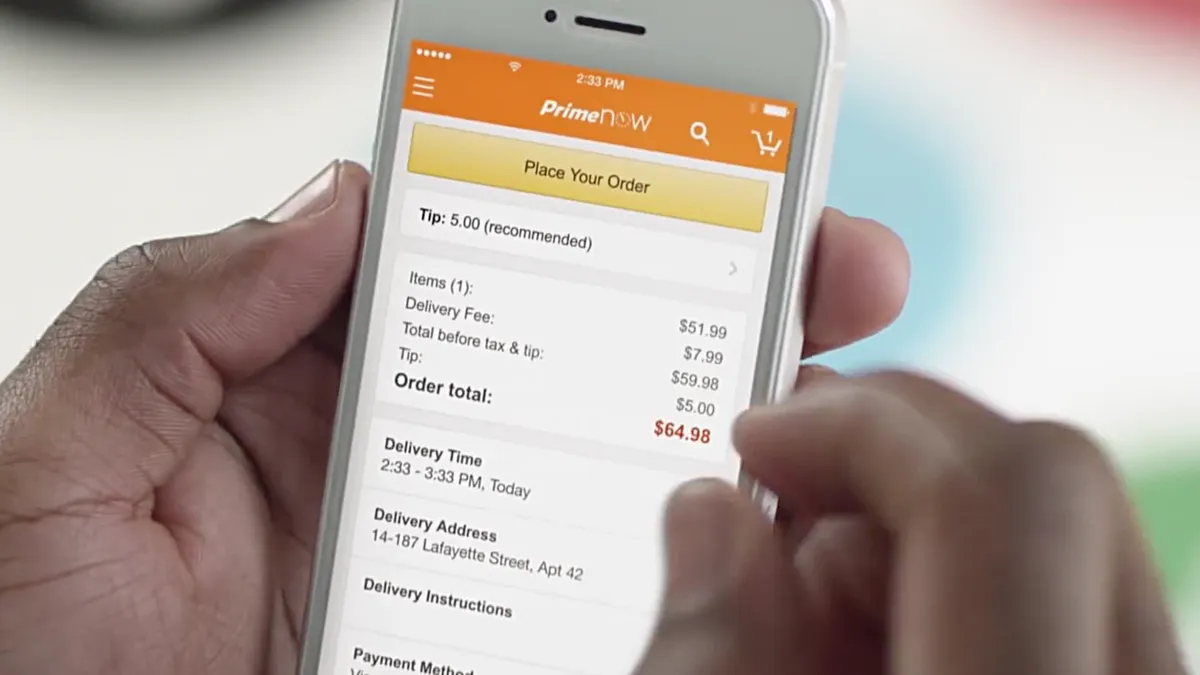

Amazon first launched Prime Now in December 2014 and has since expanded it to more than 30 metropolitan areas in the U.S. Two-hour delivery is free to Prime members in those areas, and one-hour delivery is an option for $8 or so. Beefing up Prime Now is a way to make its Prime program more valuable to members and leverage shoppers’ needs for consumer goods, which Cowen & Co. last year said could to be an important driver for the e-commerce giant.

A quarter of Amazon Prime members take advantage of the Prime Now two-hour delivery option on more than 10,000 products, according to a survey from Cowen & Co. released last year. A quarter (25%) of Amazon’s Prime members used the Prime Now service in January last year, 66% of whom were between 25 and 44 years old, according to that research, while a majority (70%) used Prime Now delivery more than once per month and 24% used it at least once per week. A majority (60%) also used Prime Now for "media:" 47% bought electronics valued under $50, 44% bought personal care products, 41% bought apparel, shoes, and accessories. A bit more than a quarter (26%) ordered items from smaller local grocery stores.

Amazon Prime Now (as with the many other same-day and even speedier delivery services) seems like an expensive delivery method, though, as Paula Rosenblum, co-founder and Managing Partner at RSR Research, pointed out last year, Amazon has taken a variety of steps to tamp down costs. For one thing, even the $8 one-hour delivery fee competes with two-day delivery costs (at least in customers’ minds, considering that Amazon and other retailers have deals with shippers), and Amazon encourages customers to add a tip to their Prime Now deliveries. Plus, packaging doesn’t have to be as secure as when it goes through the mail. Amazon has limited the number of items available for Prime Now delivery so far.

Still, while Prime Now is one of the many perks on a long list for Prime members, the $99-per-year loyalty program may not be all it's cracked up to be. In a myth-busting report on Amazon's putative retail dominance, Moody's Investors Service Charlie O'Shea last week threw doubt on the size and strength of Prime. O’Shea and his fellow analysts questioned oft-cited estimates of Amazon’s Prime membership at 85 million, which they call "seriously overstated," "highly improbable" and made "in the absence of any real guidance from the company itself." Moody’s analysts, based on an evaluation of demographic data, think the figure for Prime members is closer to 50 million, well below Costco’s total of 86.7 million members.